41+ Mortgage payment with taxes and insurance

This is an added cost that protects lenders in case borrowers default on their mortgage. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

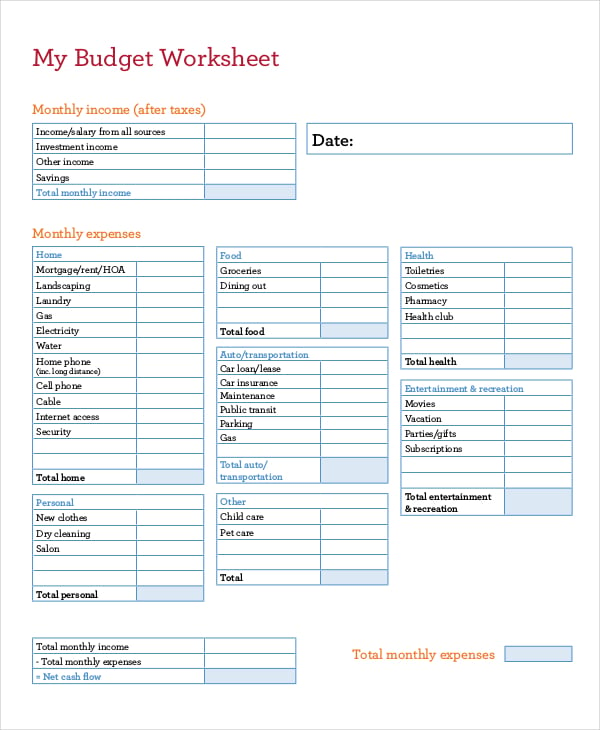

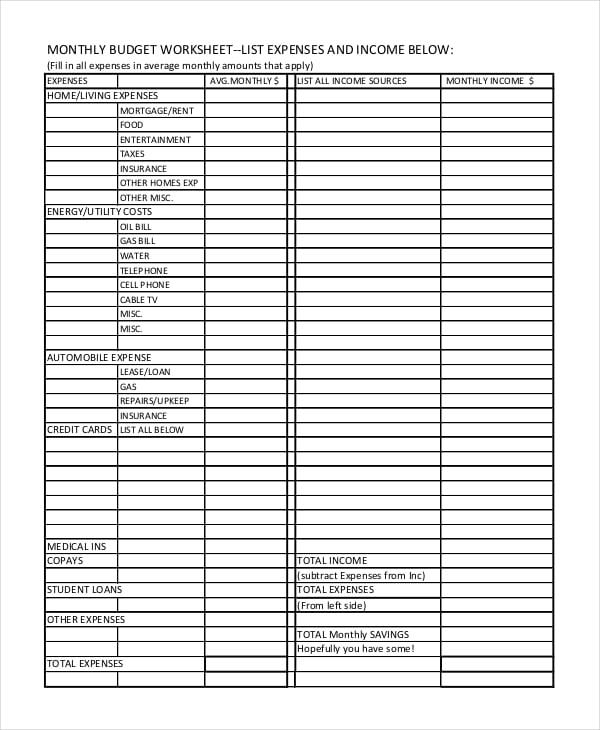

33 Expense Sheet Templates Free Premium Templates

Dont forget to factor in property taxes and mortgage insurance.

. 2500 monthly payment divided by 6000 monthly income 4167 DTI ratio. Estimate your monthly loan repayments on a 1000000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. Home buyers who have a strong down payment are typically offered lower interest rates.

Property Taxes Homeowners Insurance Loan Term. Specifically if the down payment is less than 20 of the propertys value the lender will normally. Accordingly following that written request a servicer must.

Home buyers who have a strong down payment are typically offered lower interest rates. Mortgage insurance if less than 20 down. Make sure to add taxes insurance and home maintenance to determine if you can afford the house.

The first is an upfront mortgage insurance premium UFMIP of 175 of the loan amount typically financed into the mortgage. Taking out a land loan alongside a construction loan can add complexity and risk to your finances but it is manageable as long. The required down payment will typically be in the 15 to 25 range.

Conventional loans require private mortgage insurance if you make less than 20 down payment on the homes purchase price. Mortgage insurance if less than 20 down. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

We also add in the cost of property taxes mortgage insurance and homeowners fees using loan limits and figures based on your location. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. Private mortgage insurance PMIprotects the mortgage lender if the borrower is unable to repay the loan.

Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan. Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan. Section 102641f does apply however with respect to a mortgage loan following a consumers written request to receive a periodic statement or coupon book so long as any consumer on the mortgage loan remains in bankruptcy or has discharged personal liability for the mortgage loan.

Speak with a local lender to understand any extra costs associated with the closing. If mortgage insurance payment is listed illustrative payment is based upon a conforming fixed loan for owner occupied 1 unit dwelling for a borrower with a credit score greater. Not sure how much you can afford.

These calculations are provided for illustrative purposes only and do not reflect any closing costs or down payment. With each subsequent payment you pay more toward your balance. Whats the monthly payment of a 150000 loan.

Principal refers to the loan amount. Total monthly mortgage payment. Heres a quick example of how to determine whether you can afford a mortgage assuming your monthly payment is 2500 and you make 6000 per month before taxes.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Not sure how much you can afford. How long will it take to pay off.

We also add in the cost of property taxes mortgage insurance and homeowners fees using loan limits and figures based on your location. The cost of home insurance varies according to factors such as location condition of the property and the coverage amount. There are two components to your mortgage paymentprincipal and interest.

The second is the annual mortgage insurance premium MIP that ranges from 045 to 105 of the loan amount and is divided by 12 and added to your monthly payment. 10 average downpayment. Enter your details below to estimate your monthly mortgage payment with taxes fees and insurance.

Must not be higher than 41. Use this calculator to find the monthly payment of a loan. You can also use the calculator on top to estimate extra payments you make once a year.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan. 19 2022 GLOBE NEWSWIRE -- The Austria Embedded Finance Business and Investment Opportunities Databook - 50 KPIs on Embedded Lending Insurance Payment and Wealth Segments - Q1.

PMI is usually included into your monthly mortgage payments costing between 05 1 of your loan amount annually. Enter your details below to estimate your monthly mortgage payment with taxes fees and insurance. 30-Year Fixed Mortgage Principal Loan Amount.

Monthly Taxes Insurance and PMI payment. Taxes Insurance Reviews Ratings. Taken collectively this is known as the PITI cost Principal Interest Taxes Insurance.

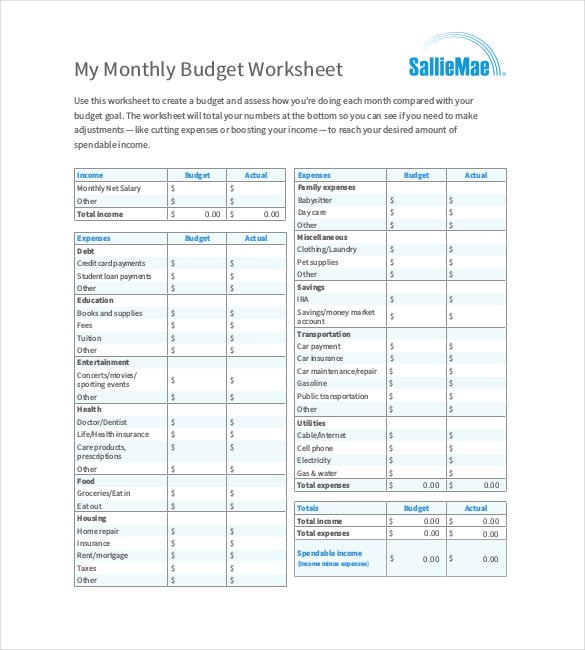

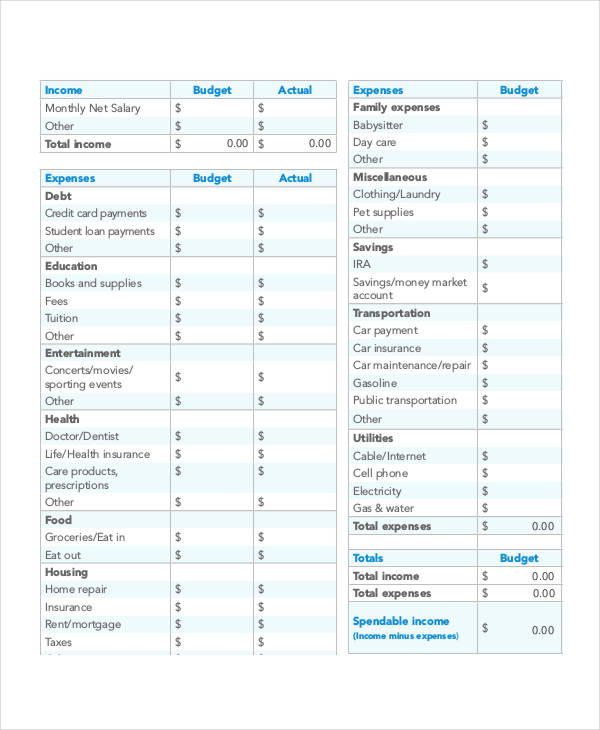

25 Monthly Budget Templates Word Pdf Excel Free Premium Templates

Pin On First Time Home Buyer

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Fha Home Loan Calculator Easily Estimate The Monthly Fha Mortgage Payment With Taxes Mortgage Loan Calculator Fha Mortgage Mortgage Amortization Calculator

How To Pay Off Your Mortgage Faster Mortgage Hacks

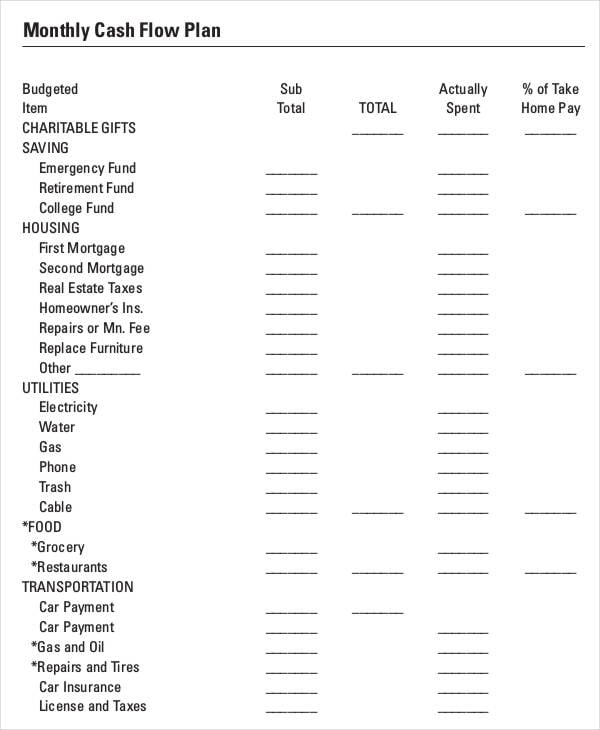

9 Monthly Sheet Templates Word Pdf Free Premium Templates

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

The Georgia Homes Group On Twitter Conventional Loan 30 Year Mortgage Home Buying Tips

8 Monthly Sheet Templates Free Sample Example Format Downlaod Free Premium Templates

Free 10 Business Expense Budget Samples In Ms Word Google Docs Google Sheets Excel

What Does Your Mortgage Payment Consist Of A Mortgage Payment Is Typically Made Up Of Four Components Principal Mortgage Payment The Borrowers Loan Amount

11 Cute Printable Monthly Budget Worksheets Cute And Free

33 Expense Sheet Templates Free Premium Templates

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning A Home You Real Estate Buying First Home Estates

How Business Relocation Expenses Get Tax Deduction Tax Deductions Deduction Relocation